Simple curiosity is less complicated to repay, whereas compound interest can help you build wealth over time because your earnings also earn cash. In taxable accounts, you pay taxes on curiosity and dividends yearly, reducing the amount obtainable to compound. Tax-advantaged accounts like 401(k)s and IRAs enable compound development with out annual tax interference, making them notably highly effective for long-term wealth building.

Inflation is the rate at which costs for items and companies rise over time. Every year, your cash might be value much less, and it won’t purchase as much because it did the 12 months before. Nevertheless, we could’ve simply as simply compounded on a semi-yearly or a quarter-yearly basis. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies.

Banks and financial establishments have standardized methods to calculate curiosity payable on mortgages and different loans, but the calculations could differ slightly from one nation to the subsequent. A fund manager has underperformed the market if a market index has offered total returns of 10% over five years, but the manager has solely generated annual returns of 9% over the same period. An funding that has a 6% annual rate of return will double in 12 years (72 ÷ 6%). An funding with an 8% annual price of return will double in nine years (72 ÷ 8%). The number of compounding periods makes a big difference when calculating compound curiosity.

In other words, the interest you earn every year gets added to your account stability. Then, the next 12 months’s curiosity is calculated primarily based on the brand new, larger steadiness, so your earnings develop at an accelerated rate. The Rule of 72 calculates the approximate time over which an funding will double at a given fee of return or interest “i.” It Is given by (72 ÷ i). It can solely be used for annual compounding but it could be very useful in planning how a lot cash you might count on to have in retirement. Where C is every lump sum and k are non-monthly recurring deposits, respectively, and x and y are the differences in time between a brand new deposit and the total period t is modeling.

Einstein can additionally be claimed to describe compound interest the 8th wonder of the World 9. In South Africa, various financial savings account choices cater to totally different preferences. Fixed-rate accounts, as an example, offer predictable curiosity, while variable-rate accounts fluctuate with market tendencies. Being knowledgeable about these selections permits for strategic financial planning. When choosing a financial savings account, think about the interest kind and how often it compounds.

If you carry a stability in your credit card, the curiosity you’re charged might be compounded, leading to a good higher steadiness. Generally, lenders allow prospects to choose whether or not they need the interest earned added to the CD or deposited in another account they will use instantly. Knowing the implications of utilizing simple or compound interest will help you make higher monetary selections.

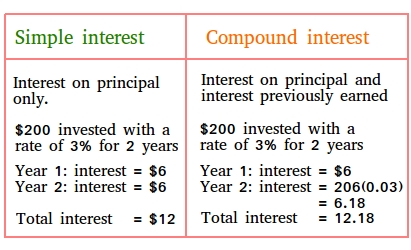

Simple curiosity is defined as the quantity paid back for borrowing money over a set time frame. Compounding demonstrates the impact of the time worth of money into the future when interest is tacked onto an preliminary deposit. For the first yr, Easy Interest (SI) is equal to https://www.simple-accounting.org/ Compound Curiosity (CI) as a outcome of no curiosity has been compounded but.

While a full mortgage calculation is complicated, let’s have a glance at how the interest portion works. To calculate your month-to-month mortgage cost, you’d need a more superior method or a devoted calculator. For this, we recommend using a specialized device like the Mortgage Calculator to handle the complexities of amortization. Easy curiosity is calculated, quite merely, on an annual foundation as a percentage of the principal quantity. You can compute easy interest by multiplying the principal quantity by the annual interest rate and by the variety of years for which you make investments or borrow money. Saxo Financial Institution A/S and its entities within the Saxo Financial Institution Group present execution-only providers, with all trades and investments primarily based on self-directed selections.

Compound curiosity earns you more money in your bank account, even if you do not add to your account within the meantime. Curiosity may be compounded day by day, month-to-month, quarterly, semiannually, or yearly. Easy curiosity and compound interest are both included within the interest formula. This extra sum, or the curiosity, should be paid in addition to the mortgage itself. The compound curiosity formula and the straightforward curiosity formulation are each discussed in the interest formula. Before investing or borrowing money, you want to double-check together with your local bank to see if the calculations are accomplished utilizing simple curiosity or compound interest.

Many private loans and auto loans make use of the easy curiosity model. Given its predictability, borrowers appreciate its simplicity, making it a common choice for short-term loans. Furthermore, it supplies clarity in understanding curiosity obligations. With the various financial situations in South Africa, it’s vital for individuals and businesses to grasp how interest rates perform.

Blossom Plus is a growing company dedicated to providing high-quality products. Our commitment to excellence is reflected in every aspect of our business, from material selection to final delivery. We aim to enrich our customers’ lives through unparalleled quality solutions.